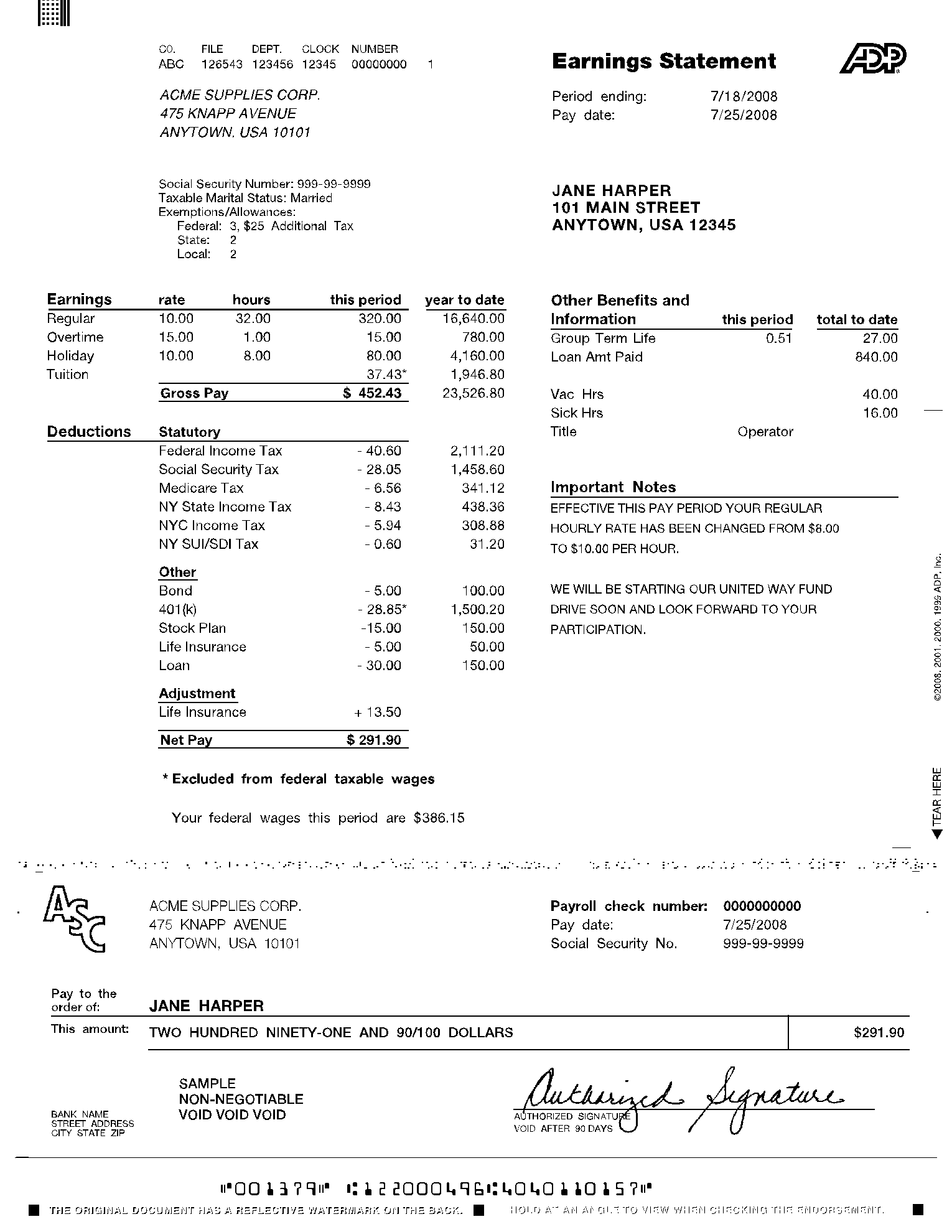

What is ADP Pay Stub Template?

A pay stub, also referred to as a check stub, is a one-page document that contains information about an employee's compensation. It illustrates how much an employee earns in a given period, the amount of tax and deductions, and how much the employee receives (i.e., net pay). Aside from that, an employer can make essential remarks concerning corporate events’ salary.

In this article, we'll go over the specifics of the ADP Pay Stub Template and how you may utilize our CocoDoc form-building tool to fill it out rapidly. This article can assist managers and workers in understanding Adp pay stubs correctly.

What is on an ADP Pay Stub Template?

A pay stub contains various facts that enable employers and employees to keep track of payments, taxes, and deductions, they include:

Company details

A pay stub should specify the employer’s name, address, and signature, as well as, the employee’s details like name, address, and social security number (or SSN)

Period and payment date

It is a must to include both the pay period net pay and year-to-date net pay on the check stub.

Gross wages

Gross wages are the amount of income you owe an employee before taxes and deductions. Any nontaxable income falls under gross wages. The pay stub usually has two columns showing: current gross pay and year-to-date gross pay. The gross salary section may also include:

- Total hours worked: The number of hours worked is included on pay stubs for an hour and nonexempt compensated personnel.

- Pay rate: It can be hourly, monthly salary, or other separate pay rates (s) like overtime, double-time, etc.

Deductions

Paystub deductions vary based on your employee perks. Among them are voluntary and involuntary contributions, charitable contributions, federal income tax, FICA, state and local income taxes, etc.

Employer contributions

Employers must include their contributions such as health insurance premiums, 401(k) plans, FUTA, SUTA, FICA, and other employee benefits.

Employer taxes

Employers must also pay (FUTA tax), (SUTA tax), and the employer proportion of FICA tax for every employee.

Net pay

It's the total amount employers pay to an employee after subtracting taxes and other deductions from their gross earnings.

Quick Steps to Fill out and eSign Adp Pay Stub Template Online

An employer must complete the Adp pay stub form and send one copy to a relevant employee. We'll show you how to fill out the form step by step below.

Step 1: Add your company's information

Move to the top-left of the page. Enter your company's information starting with its full legal name and complete address (with a postal code).

Step 2: Enter the payment period

Proceed to the right and specify the time frame for which your employee will receive this form by adding payday and when the period is ending.

Step 3: Identify the employee

Below the period column, insert the worker's name, address, (SSN), taxable marital status, and other tax-related information.

Step 4: Describe the earnings

You must include all acceptable forms of earnings in this section, like regular salary, overtime bonus, tuition fees, and vacation pay. For each category, fill out the " Pay Rate," "hours worked," "this period," and "year to date" columns. See below:

-

- Fill in the blanks with the worker's earnings: multiply their hourly rate by the number of hours they worked during the specified time to get each line’s "this period" result.

- At the bottom of the "this period" enter the entire gross sum.

- Fill in the amount received by the worker since the year began in the "year to date" section.

Step 5: Add Deduction Info.

Move down to the table below the "Earnings" table and define your employee's deductions from the earnings.

-

- Enter any applicable taxes, insurance payments, loans, amounts transferred to retirement plans, and other deductions.

- Calculate the total cost. Subtract the total deductions from the gross pay earned above to get the net pay.

- Add the results figure in the "Net pay" area.

Step 6: Provide Additional Benefits and Information

Shift to the "Other benefits and information" column, and fill out all applicable sections with correct details, like the incentives paid while the employee was ill or on vacation.

Step 7: Include Important Remarks

Write down any important information you wish to convey to the worker. For example, you can alert employees about any wage increases that will take full effect soon. This field is optional.

Step 8: Completing the Check

If you pay your employees with paychecks, you'll have to fill out a payroll check on the bottom part of the pay stub.

-

- Enter your company's name and address.

- Add the check number, the payment date, and the employee's Social Security number(SSN).

- Fill in the payee's name and the amount in words, plus the total amount in numbers on the right.

Your bank's information should appear on the left, below (its name and address).

Read the document thoroughly to ensure that all fields are filled out with the correct information. Then, download, save, print, or share straight from the editor. Using our CocoDoc e-signature technology, add a legally enforceable eSignature in the appropriate line. You can also print and sign it by hand.

What is ADP Pay Stub Templates Used For?

The ADP Pay Stub Template includes information both employers and employees can use.

The document will assist workers in fully understanding all earnings received during a specific timeframe and total deductions from the amount earned and verify they were paid correctly.

A pay stub is proof of income, when a worker wishes to apply for a loan, obtain a mortgage, or rent a property/ apartment must use a pay stub document.

In any organization, ADP pay stubs confirm that it has transferred a specific amount to an employee's account. In case of discrepancies with employee compensation, employers can refer to the pay stubs to resolve the issue raised. During tax season, employers can also use check stubs to complete each employee's Form W-2.

Who Needs an ADP Pay Stub Template?

As per the US Department of Labor, Fair Labor Standards Act, pay stubs confirm that your workforce is categorized as employees, not freelancers and that you are paying income taxes.

Small-business owners are the primary users of the pay stub template. They can easily download free pay stub templates and tweak them to fit their requirements.

Adp Pay Stubs Template External Resources

Consult your state for more information on pay stub requirements. Discover more about pay stubs with the following links:

- https://www.uslegalforms.com/form-library/36133-adp-earning-statement-sample

- https://sbshrs.adpinfo.com/year-end-payroll-guide-nf#span_style_color_5378d6november_span

- https://www.loyola.edu/department/financial-services/payroll/pay-stub/how-read

- https://www1.nyc.gov/site/opa/my-pay/pay-statement-explained.page

The procedure of calculating an employee's net pay should be straightforward. CocoDoc online ADP pay stubs template allows employers to record hours worked, approve payroll simply, and print pay stubs with a simple step-by-step process from anywhere, at any time.